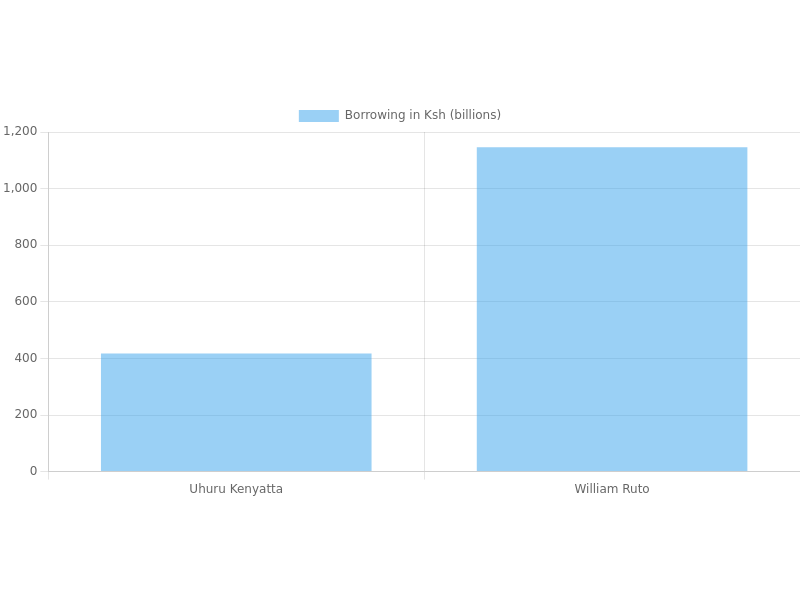

President William Ruto’s administration has set a new record in Kenya’s loan history. In the first nine months of his tenure, the government borrowed over Ksh1.2 trillion. This figure surpasses the amount former President Uhuru Kenyatta borrowed in his first year in office.

The treasury’s statistics illustrate that the Kenyatta administration accrued Ksh437 billion in its inaugural year and approximately Ksh874.5 billion between 2013 and 2015.

Ruto, who committed to reducing loan debts during his campaign. He has since last September accepted Ksh419.46 billion from domestic financiers and a further Ksh716.92 billion from overseas markets.

The design of this surge in obligations is to bolster the state coffers, finance projects and salaries. It enhances foreign reserves to protect the devaluing shilling.

On July 17, a Monday, the International Monetary Fund (IMF) sanctioned Kenya’s most recent appeal for a Ksh142 billion loan. It escalated the cumulative amount of funds delivered by the IMF to Ksh229.73 billion over the past year.

This represents the most significant loan from the IMF program ever granted to Kenya, the previous high being a loan of Ksh87.73 billion in December 2022 during the fourth appraisal.

Bank Consortium Loans

On May 19, 2023, the administration received Ksh127 billion from a syndicate of global creditors, including the US-based CitiGroup, Standard Chartered Bank from the UK, and South Africa’s Standard Bank and Rand Merchant Bank.

A fortnight later, Kenya obtained a further disbursement of Ksh141 billion from the World Bank to support its budget.

In July 2023, the nation also secured a Ksh70.55 billion syndicated loan, which they projected for allocation towards approved development initiatives during the 2023/2024 fiscal year.

As per the recent data from the Central Bank of Kenya (CBK), between September and November 2022, Ruto accrued Ksh137.48 billion in debt. This borrowing comprised Ksh50.42 billion in September, Ksh21.85 billion in October, and Ksh65.21 billion in November.

The escalation in national debt exhibits the government’s increasing propensity to borrow a loan, which starkly contradicts President William Ruto’s pre-election assurances.

In March 2023, Ruto’s Cabinet endorsed a rise in the debt ceiling from the initial Ksh10 trillion cap to a debt anchor corresponding to 55 percent of the nation’s Gross Domestic Product (GDP).

Loan Debt Pressures

According to the Central Bank’s records, Kenya’s yearly Gross Domestic Product (GDP) growth was 4.8 percent in 2022.

Meanwhile, Kenya Kwanza’s government has been compelled to allocate Ksh7 trillion for servicing the national debts loans in the next half-decade.

In November 2022, Njuguna Ndung’u, the Treasury Cabinet Secretary, voiced concerns over the nation’s swelling debt, indicating that the country was running out of borrowing capacity.

This occurred when the president pressured the Kenya Revenue Authority (KRA) to generate more income to launch development projects to fulfill election commitments.

During Ruto’s first half-year in office, the Kenya Kwanza administration allocated Ksh578.4 billion for debt servicing instead of the Ksh501 billion set aside during the same period under Uhuru’s administration.

Economic scholars have called out Ruto for his inconsistency, noting that despite his continuous assertions that his government will not accumulate more debt, there has been a visible uptick in borrowing.

In a prior event, Ruto urged the Kenya Revenue Authority (KRA) to strengthen its policies and eradicate all corruption gaps to hit its Ksh4 trillion revenue collection goal.

During the first six months of Ruto’s term, KRA gathered Ksh928.1 billion and is projected to amass Ksh2.57 trillion in the 2023/24 fiscal year.

ALSO CHECKOUT: The passport issue

A Brief on Kenya’s Loan Debt

The first president of Kenya, Mzee Jomo Kenyatta, started with a debt of Ksh1.17 billion and left it at Ksh1.72 billion at his passing in 1978.

Daniel Moi, the second president, borrowed a total of Ksh630 billion during his 24-year rule, while ex-President Mwai Kibaki left the nation with a debt of Ksh1.8 trillion.

Uhuru Kenyatta, who served as the fourth president of Kenya, is often linked with the country’s significant loan debt load. Under his leadership, the nation’s debt escalated to Ksh8.7 trillion, a marked increase from the Ksh1.8 trillion debt inherited from his predecessor, President Mwai Kibaki.